QuickBooks accounting and time tracking, RestaurantOps and Deputy, Square

QuickBooks, Xero, When I Work, PosterElite and more Gusto is designed with dynamic small businesses in mind, so it can fit the needs of a lean restaurant that wants to automate and streamline processes as much as possible. It also includes a Contractor Only plan for $0 per month plus $6 per contractor paid. Plus: $80 per month + $12 per person paid.Simple: $40 per month plus $6 per person paid.Gusto offers three monthly pricing tiers: Gusto also makes it easy for employees to dedicate a portion of their paychecks to charity, and Gusto Wallet is a full-service bank account that lets employees access their paychecks earlier than payday. You can also administer benefits, such as health insurance, retirement plans and custom benefits. It facilitates automated payroll for employees and contractors and files and pays taxes and files W- forms automatically in all 50 states. DON'T TRUST THEM! THEY ARE POOR STEWARDS.Gusto is an online payroll and benefits management platform with a self-service employee portal.

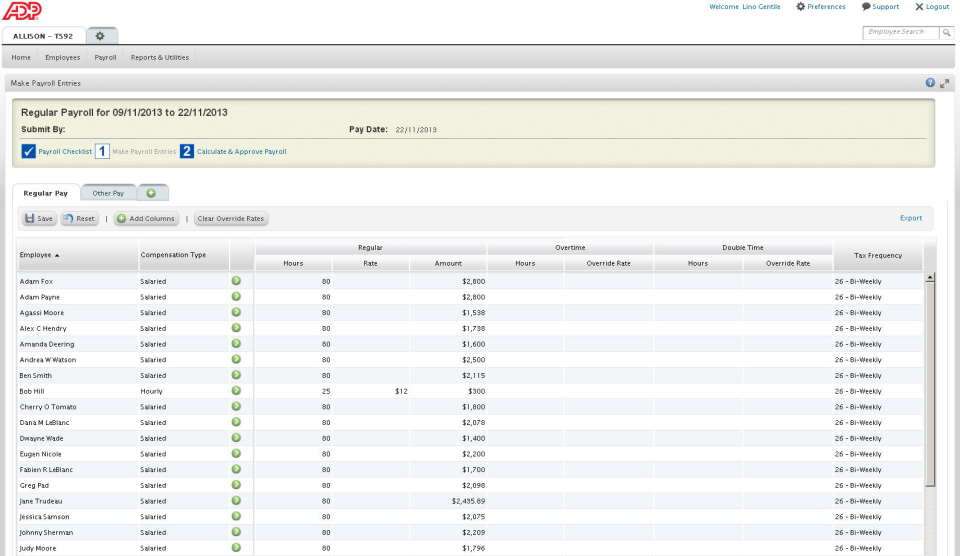

I was so relieved!! Two weeks later, I received an invoice for another $3200.00 that they took the liberty of debiting from our account! When I called to confront them and ask what in the heck was going on- they simply said that they couldn't be responsible for our taxes and that they were authorized to take it out of our account. After relentless and time consuming insistence that they pay this and not us they finally admitted all this was their error and that they would take financial responsibility for whatever was owed. In July, the state of CA garnished our bank account for $7350.00. I was told 4x "not to worry about it that this was normal for these things to get ironed out." Finally, exacerbated, I called again and told them that this was on them- due to mistakes they had made and that we should not be liable for any of it. Over the course of the next 7 months I continued to call them as the statements kept getting higher and higher. I notified ADP after I received the first notice from CA when the amount due was around $2-3,000.00 and they informed me that they were handling it and to ignore the statements being sent- that it was likely a mistake by the state of CA but reassured me multiple times that their tax department was handling it. Over the course of 9 months ADP created a liability for our clinic of over $20,000 in unemployment taxes, penalties and late fees and interest because they failed to pay the CA-EDD as biweekly taxes are supposed to be paid.

0 kommentar(er)

0 kommentar(er)